1001.0: The Mathematics of Quantitative Finance - Part 1

Hi! Welcome to this 3-part series on the mathematics behind quantitative finance! Took a while to return, but I'm done with IB exams now (well... since mid-May, really. But I've been on holiday or busy on and off since). Anyways, this part of the series will cover:

Introduction to Quantitative Finance

Fundamental Mathematics in Quantitative Finance

Financial Instruments and Markets

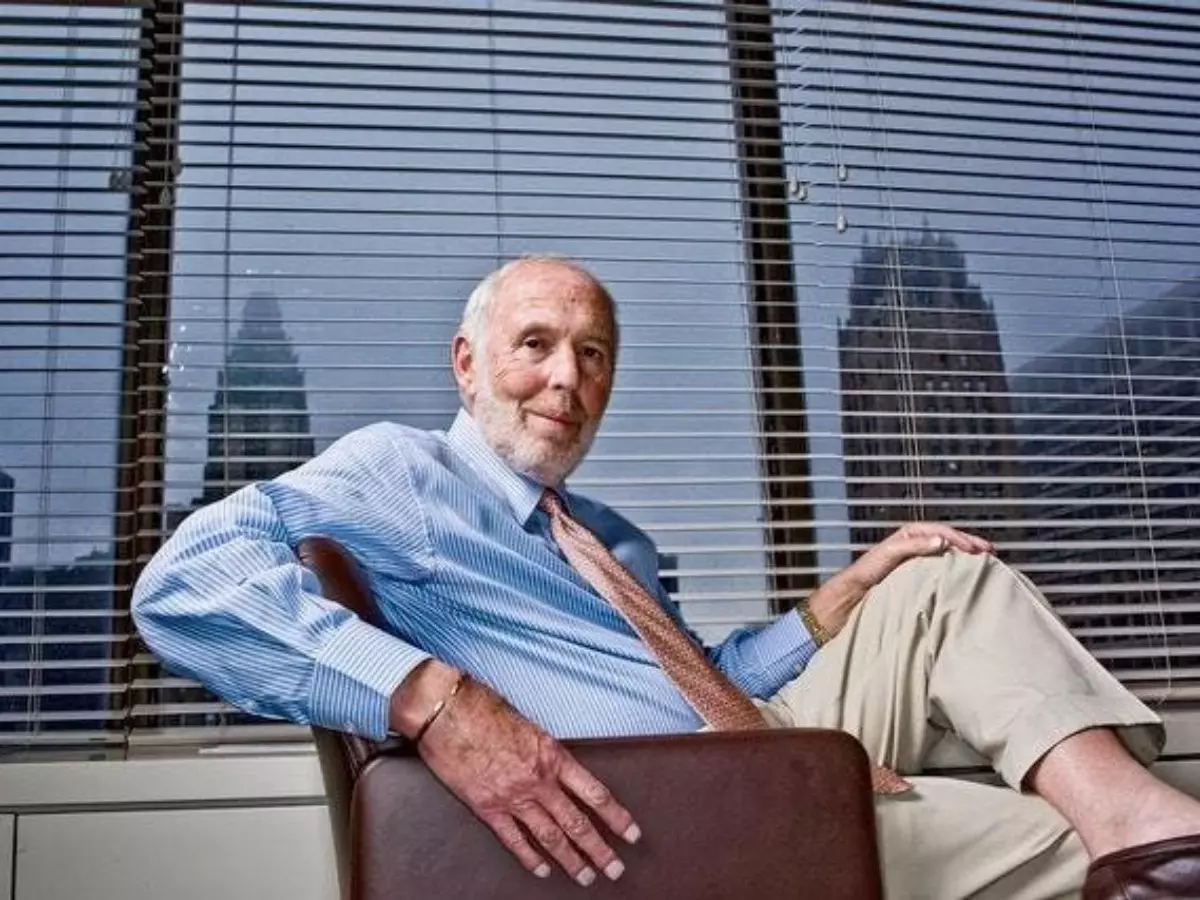

Rest in Peace to Jim Simons, whom this series is dedicated to.

Jim Simons, founder of Renaissance Technologies and Father of Modern Quantitative Finance

Introduction to Quantitative Finance

Overview of Quantitative Finance

Quantitative finance is a field that uses mathematical models, statistical techniques, and computational tools to understand and solve financial problems. It plays a crucial role in the financial industry by providing methods for pricing complex securities, managing risk, and optimizing portfolios. Quantitative finance integrates a wide range of disciplines, including finance, mathematics, statistics, and computer science, making it an interdisciplinary and highly technical field. Its applications span various areas such as asset pricing, derivative modeling, risk management, and algorithmic trading, making it essential for the functioning of modern financial markets.

Importance and Applications

The importance of quantitative finance cannot be overstated, as it underpins many of the operations and decision-making processes within financial institutions. It allows for the precise valuation of financial instruments, which is crucial for trading, investment, and risk management. For instance, quantitative models are used to price derivatives like options and futures, which are essential for hedging and speculation. Additionally, quantitative finance helps in assessing and managing financial risks, such as market risk, credit risk, and operational risk. By using statistical and mathematical models, financial analysts can forecast market trends, evaluate the performance of portfolios, and develop trading strategies that maximize returns while minimizing risks. The field also plays a pivotal role in regulatory compliance, helping institutions meet stringent financial regulations and standards.

Key Mathematical and Programming Concepts

To excel in quantitative finance, a solid understanding of various mathematical and programming concepts is essential. Key mathematical concepts include:

Probability Theory: Understanding the likelihood of different financial outcomes and events.

Calculus: Used for modelling and understanding changes in financial variables, such as interest rates and stock prices.

Linear Algebra: Important for portfolio optimization, risk management, and other financial applications.

On the programming side, proficiency in languages such as Python, R, C++, and MATLAB is critical. These languages are widely used for developing and implementing financial models, performing data analysis, and automating trading strategies. Knowledge of data structures and algorithms is also important, as it enables efficient handling of large datasets and complex computations. In addition to these core areas, familiarity with financial libraries and frameworks, such as NumPy, pandas, and QuantLib, can greatly enhance one's ability to build and test financial models.

Fundamental Mathematics in Quantitative Finance

Probability and Statistics

In quantitative finance, probability and statistics are used to model and manage uncertainty. Key concepts include:

Probability Distributions: These describe how the probabilities are distributed over the values of the random variable. For instance, the Normal Distribution is defined by its mean \(\mu\) and standard deviation \(\sigma\), and its probability density function (PDF) is given by:

\[

f(x) = \frac{1}{\sqrt{2\pi\sigma^2}} e^{-\frac{(x - \mu)^2}{2\sigma^2}}

\] *

This function is crucial in finance as many asset returns are assumed to follow a normal distribution.

Expected Value (E[X]): Represents the long-run average value of a random variable \(X\). For a discrete random variable:

\[

E[X] = \sum_i x_i P(x_i)

\]

For a continuous random variable, the expected value is:

\[

E[X] = \int_{-\infty}^{\infty} x f(x) dx

\]

This value is fundamental in calculating the expected returns of assets.

Variance and Standard Deviation: Measure the variability or risk associated with a random variable. Variance is defined as:

\[

\text{Var}(X) = E[(X - E[X])^2]

\]

Standard deviation, \(\sigma\), is the square root of the variance and provides a measure of risk in the same units as the variable itself:

\[

\sigma = \sqrt{\text{Var}(X)}

\]

Calculus and Linear Algebra

Calculus helps in modeling the dynamic nature of financial markets:

Differentiation: In the context of financial derivatives, differentiation helps calculate the sensitivity of the derivative's price to changes in underlying variables. For example, Delta (\(\Delta\)) measures the sensitivity of an option's price (\(V\)) to changes in the underlying asset price (\(S\)):

\[

\Delta = \frac{\partial V}{\partial S}

\]

Another example is the Gamma (\(\Gamma\)), which measures the rate of change of Delta with respect to changes in the underlying asset price:

\[

\Gamma = \frac{\partial^2 V}{\partial S^2}

\]

Integration: Used to calculate quantities such as the present value of future cash flows. For example, the present value (\(PV\)) of a continuous stream of cash flows \(C(t)\) discounted at rate \(r\) is given by:

\[

PV = \int_0^T C(t) e^{-rt} dt

\]

This is used in bond pricing and other financial valuations.

Linear Algebra: In portfolio management, linear algebra helps in optimizing the asset allocation. The expected return of a portfolio (\(\mu_p\)) is a weighted sum of the expected returns of the individual assets:

\[

\mu_p = w^T \mu

\]

where \(w\) is the vector of portfolio weights and \(\mu\) is the vector of expected returns. The portfolio's variance (\(\sigma_p^2\)) is given by:

\[

\sigma_p^2 = w^T \Sigma w

\]

where \(\Sigma\) is the covariance matrix of asset returns. Minimizing this variance while achieving a desired return is a common optimization problem in finance.

Stochastic Processes

Stochastic processes model the random evolution of financial variables over time:

Brownian Motion (Wiener Process): A fundamental stochastic process with continuous paths and stationary, independent increments. It is denoted by \(W(t)\) and has the properties:

\[

E[W(t)] = 0 \quad \text{and} \quad \text{Var}(W(t)) = t

\]

Brownian motion is a key component of the Geometric Brownian Motion (GBM) model, used to describe the stochastic process followed by stock prices:

\[

dS(t) = \mu S(t) dt + \sigma S(t) dW(t)

\]

Here, \(S(t)\) represents the stock price at time \(t\), \(\mu\) is the drift rate, \(\sigma\) is the volatility, and \(dW(t)\) represents the increment of a Brownian motion.

Itô's Lemma: A fundamental result in stochastic calculus used to find the differential of a function of a stochastic process. If \(f(t, S(t))\) is a function of time \(t\) and a stochastic process \(S(t)\), then Itô's Lemma states:

\[

df = \left(\frac{\partial f}{\partial t} + \mu S \frac{\partial f}{\partial S} + \frac{1}{2}\sigma^2 S^2 \frac{\partial^2 f}{\partial S^2}\right) dt + \sigma S \frac{\partial f}{\partial S} dW

\]

This lemma is instrumental in deriving the Black-Scholes partial differential equation for option pricing.

Numerical Methods and Optimization

Numerical methods are employed when analytical solutions are impractical:

Finite Difference Methods: Used to numerically solve partial differential equations (PDEs), such as the Black-Scholes equation for option pricing. For example, the Crank-Nicolson method is an implicit finite difference method that is often used due to its stability and accuracy. It discretizes time and space, and iteratively solves for the option price at each grid point.

Monte Carlo Simulation: A powerful technique used to approximate the value of complex financial derivatives and for risk management. It involves simulating a large number of possible scenarios for the evolution of the underlying variables. The expected value of the payoff, discounted at the risk-free rate, provides an estimate of the derivative's value:

\[

V = e^{-rT} \frac{1}{N} \sum_{i=1}^N f(S_T^{(i)})

\]

where \(r\) is the risk-free rate, \(T\) is the maturity, \(f(S_T^{(i)})\) is the payoff function, and \(N\) is the number of simulations.

Optimization Techniques: In portfolio optimization, the goal is to find the asset allocation that maximizes the expected return for a given level of risk, or equivalently, minimizes the risk for a given level of expected return. This can be formulated as a quadratic programming problem:

\[

\min_w \frac{1}{2} w^T \Sigma w \quad \text{subject to} \quad w^T \mu = \mu_p, \quad \sum_i w_i = 1

\]

where \(\mu_p\) is the desired portfolio return. The solution provides the optimal weights \(w\) for the assets in the portfolio.

Financial Instruments and Markets

Equity and Debt Securities

Financial instruments are contracts that represent an ownership position, a creditor relationship, or a right to ownership. Equity and debt securities are fundamental categories:

Equity Securities: Represent ownership in a company and include stocks (common and preferred shares). The value of equity securities is influenced by the company's earnings, growth prospects, and market conditions. The price of a stock, \(P\), can be modeled as:

\[

P = \frac{D}{r - g}

\]

where \(D\) is the expected dividend, \(r\) is the required rate of return, and \(g\) is the growth rate of dividends. This is known as the Gordon Growth Model.

Debt Securities: Represent a loan made by an investor to a borrower. Debt securities include bonds, which pay periodic interest (coupons) and return the principal at maturity. The price of a bond, \(B\), can be calculated as the present value of its future cash flows:

\[

B = \sum_{t=1}^T \frac{C}{(1 + r)^t} + \frac{F}{(1 + r)^T}

\]

where \(C\) is the annual coupon payment, \(r\) is the yield to maturity, \(F\) is the face value, and \(T\) is the time to maturity.

Derivatives (Options, Futures, Swaps)

Derivatives are financial contracts whose value is derived from an underlying asset or group of assets. They are used for hedging, speculation, and arbitrage:

Options: Provide the right, but not the obligation, to buy (call) or sell (put) an asset at a specified price before a certain date. The value of an option can be calculated using the Black-Scholes model, which is based on the assumption that the underlying asset follows a geometric Brownian motion. The Black-Scholes formula for a European call option is:

\[

C = S_0 N(d_1) - X e^{-rT} N(d_2)

\]

where \(S_0\) is the current stock price, \(X\) is the strike price, \(r\) is the risk-free rate, \(T\) is the time to maturity, and \(N(\cdot)\) is the cumulative distribution function of the standard normal distribution. The terms \(d_1\) and \(d_2\) are defined as:

\[

d_1 = \frac{\ln(S_0 / X) + (r + \sigma^2 / 2) T}{\sigma \sqrt{T}}

\]

\[

d_2 = d_1 - \sigma \sqrt{T}

\]

where \(\sigma\) is the volatility of the underlying asset.

Futures: Contracts to buy or sell an asset at a future date for a price agreed upon today. The pricing of futures contracts involves the cost of carry, which includes storage costs, insurance, and the interest rate. The futures price \(F_t\) can be expressed as:

\[

F_t = S_t e^{(r + c - y)(T-t)}

\]

where \(S_t\) is the spot price, \(r\) is the risk-free rate, \(c\) is the cost of carry, \(y\) is the convenience yield, and \(T\) is the time to maturity.

Swaps: Agreements to exchange cash flows between two parties. The most common type is the interest rate swap, where one party pays a fixed rate and the other pays a floating rate. The value of a swap is the difference in the present value of the fixed and floating cash flows. For a plain vanilla interest rate swap, the net present value (NPV) of the swap can be calculated as:

\[

\text{NPV} = \sum_{t=1}^T \left[\frac{F_t}{(1 + r)^t} - \frac{L_t}{(1 + r)^t}\right]

\]

where \(F_t\) represents the fixed rate payments and \(L_t\) represents the floating rate payments.

Foreign Exchange and Commodities

These markets deal with currencies and physical goods:

Foreign Exchange (Forex) Market: The largest and most liquid market, where currencies are traded. Exchange rates fluctuate based on factors like interest rates, economic data, and geopolitical events. The forward exchange rate can be determined using the covered interest rate parity, which states:

\[

F = S \left(\frac{1 + r_d}{1 + r_f}\right)

\]

where \(F\) is the forward rate, \(S\) is the spot rate, \(r_d\) is the domestic interest rate, and \(r_f\) is the foreign interest rate.

Commodities Market: Includes physical goods like metals, energy, and agricultural products. Prices in the commodities market are influenced by supply and demand dynamics, geopolitical events, and market speculation. The price of a commodity futures contract can be modeled similarly to financial futures, considering factors like storage costs and convenience yields.

Fixed Income Securities

These are debt instruments that pay fixed interest and return the principal at maturity:

Bond Pricing: Bonds are priced based on the present value of future cash flows, discounted at the yield to maturity. For zero-coupon bonds, which pay no interest but are sold at a discount, the price is:

\[

P = \frac{F}{(1 + r)^T}

\]

where \(F\) is the face value, \(r\) is the yield, and \(T\) is the time to maturity.

Yield Curve: Represents the relationship between interest rates and different maturities. The yield curve is crucial for pricing and managing fixed income portfolios. The shape of the yield curve can indicate economic expectations, such as an upward-sloping curve suggesting economic expansion and rising interest rates.

These financial instruments and markets form the foundation of the financial system, enabling investors and institutions to manage risk, speculate, and achieve their financial goals. Understanding the mathematical models and pricing mechanisms behind these instruments is essential for effective financial analysis and decision-making.

*For the whole blog post: Equations are written in LaTeX, view them here: https://latex2image.joeraut.com/

If you enjoyed this post, do leave a comment and a like! Check out the beta version of my new game: JetRide Fly

01001100 01101001 01110110 01100101 00100000 01001100 01101111 01101110 01100111 00100000 01100001 01101110 01100100 00100000 01010000 01110010 01101111 01110011 01110000 01100101 01110010 00100001 (No, your computer isn't hanging).

Check my profile to contact me at my e-mail address.

Comments

Post a Comment